does nc have sales tax on food

State Sales Tax. The transit and other local rates do not apply to qualifying.

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

At a total sales tax rate of 675 the total cost is 37363 2363 sales tax.

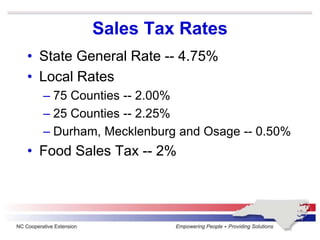

. Lowest Effective Sales Tax Rate. But North Carolina does charge the 2 or 225 percent local sales tax. The North Carolina NC state sales tax rate is currently 475.

This page describes the taxability of. To learn more see a full. In most states necessities such as groceries clothes and drugs are exempted from the sales tax.

North Carolina has state sales tax of 475 and allows local governments to collect a local option sales tax of up to 275. Highest Effective Sales Tax Rate. Where can I go to learn more about why North Carolina does require sales tax on vitamins and supplements.

For example a service whose work includes creating or manufacturing a product it is very likely considered to. The State of North Carolina charges a sales tax rate of 475 Counties and municipalities in North Carolina. 35 rows Sales and Use Tax Rates Effective October 1 2020 Listed below by.

North Carolina Sales Tax Rates The following rates apply at the state and city level. The cash option however is driven by ticket sales. The local sales tax.

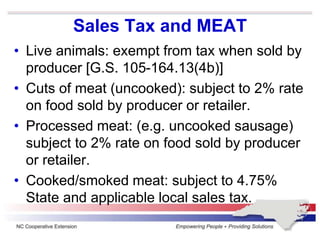

Make Your Money Work A number of categories of goods also have different sales tax rates. 53 rows Eleven of the states that exempt groceries from their sales tax base include both candy and soda in their definition of groceries. While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

In the state of North Carolina services are not generally considered to be taxable. North Carolina charges sales tax on 50 percent of the cost of a modular or manufactured home including skirting gutters siding upgrades and other accessories attached when delivered. North Carolina Sales Tax.

The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and beverages in. 2022 List of North Carolina Local Sales Tax Rates. 105-16413B gives the various exemptions and.

But North Carolina does charge the 2 or 225 percent local sales tax. While some jurisdictions have no income tax or do not tax lottery winnings others impose a top tax rate of more than 10. North Carolina Sales of grocery items are exempt from North Carolina state sales tax but still subject to local taxes at a uniform reduced rate of 2.

A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food. Qualifying Food A 200 local rate of sales or use tax applies to retail sales and purchases for storage use. Groceries and prepared food are subject to special sales tax rates under North Carolina law.

Statewide North Carolina Sales Tax Rate. We include these in their state sales.

North Carolina Sales Tax Update

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Journal Of The House Of Representatives Of The General Assembly Of The State Of North Carolina 1997 1998 Extra Session State Publications Ii North Carolina Digital Collections

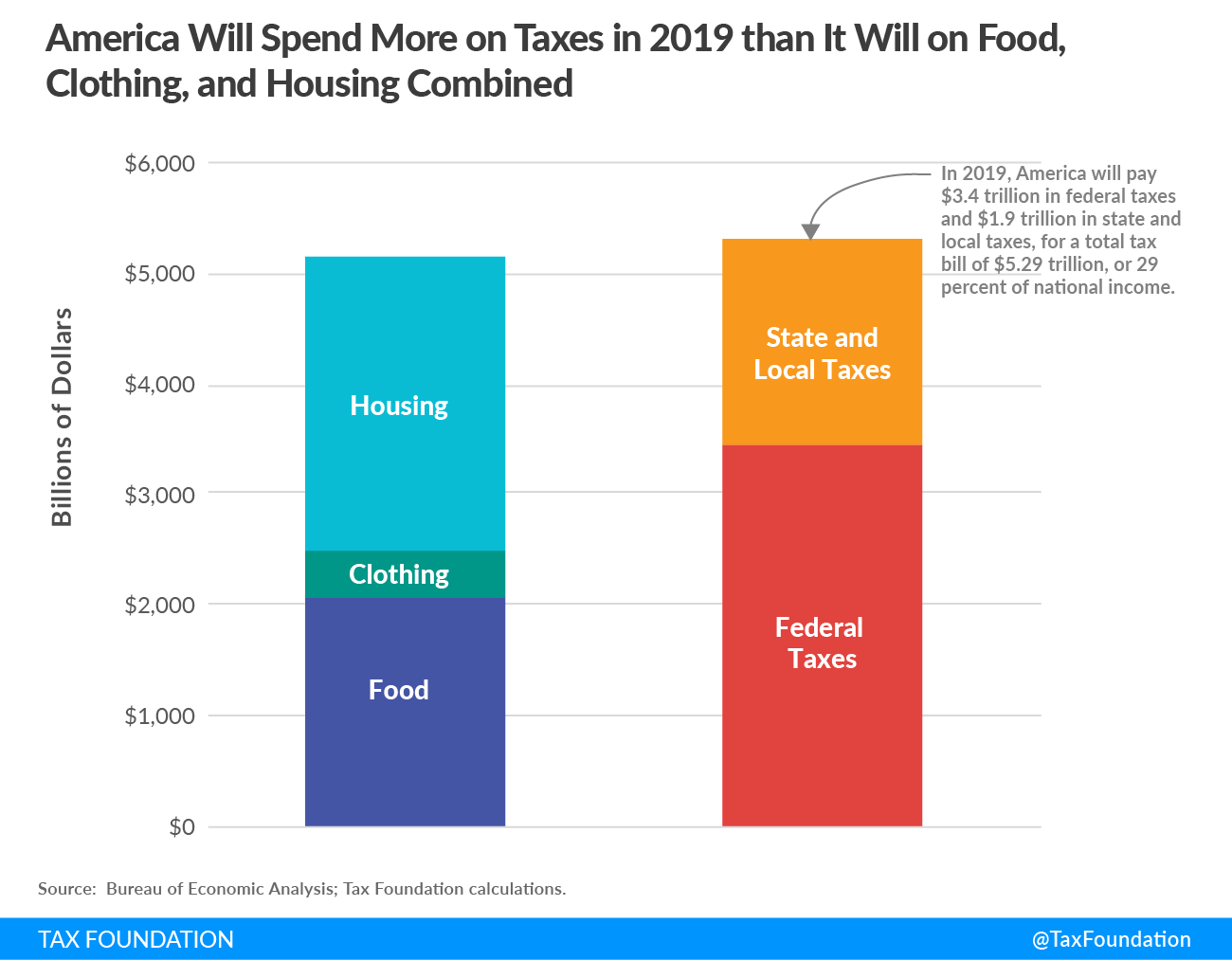

National Tax Freedom Day Is Today Five Days After N C Reached Tax Freedom

Council On The Status Of Women Subject Files Sales Tax Philosophy Council On The Status Of Women North Carolina Digital Collections

How Are Groceries Candy And Soda Taxed In Your State

North Carolina 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Is Food Taxable In North Carolina Taxjar

Kansas Gop House Leader Claims Credit For Food Tax Phaseout The Wichita Eagle

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

How To File And Pay Sales Tax In North Carolina Taxvalet

New Jersey Sales Tax Rate 2022

Food Tax Repeal Think New Mexico

Nc Says Good Bye To Earned Income Tax Credit Only State To Do So In 30 Years Wunc

State And Local Sales Tax Rates Sales Taxes Tax Foundation

Bill That Would Let Some Snap Users Buy Prepared Food Has Bipartisan Support Sdpb

Articles Of Sales Tax Distribution Nc Department Of Revenue